What Is a Spinning Top Candlestick?

Since candlestick patterns are representations of market action, they give us interesting insights into what the market has been up to. If you look at a spinning top in isolation it does not mean that much. It just conveys indecision as both bulls and bears were not able to win the markets. However, when you see the spinning top with respect to the prevalent trend in the market it gives out a really strong signal based on which you can position your trade in the markets.

Smash Mouth Frontman Steve Harwell Dies at 56 – KQED

Smash Mouth Frontman Steve Harwell Dies at 56.

Posted: Mon, 04 Sep 2023 17:55:50 GMT [source]

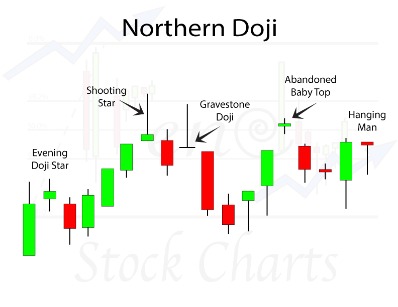

It comprises of three short reds sandwiched within the range of two long greens. The pattern shows traders that, despite some selling pressure, buyers are retaining control of the market. Doji candles resemble a cross or plus sign, depending on the length of the shadows. The prominent trait of a doji is an extremely narrow body, meaning that the open and close prices are the same or very nearly the same. The high and low for the day determine the length of this candle’s upper and lower shadows.

How Traders Use a Spinning Top Candlestick Pattern

Candlestick charts are one of the most popular components of technical analysis, enabling traders to interpret price information quickly and from just a few price bars. A spinning top occurring at the peak of an uptrend can signify that the bullish is losing track spinning top candle and the trend is about to reverse. However, when a spinning top is at the base of a downtrend, it is a sign that the bearish is losing control, and the bullish may take control. It means that a spinning top may alert about an upcoming crucial change in a trend.

Millennials Embrace Bicentennial Style – The New York Times

Millennials Embrace Bicentennial Style.

Posted: Thu, 31 Aug 2023 07:00:00 GMT [source]

In a downtrend, the bears have total control as they keep making the prices fall. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. Please consider the Margin Trading Product Disclosure Statement (PDS), Risk Disclosure Notice and Target Market Determination before entering into any CFD transaction with us.

How to trade with Spinning Top: Candlestick Pattern

The candlestick pattern signifies uncertainty over the asset’s future course. In this article, we’re going to take a closer look at the spinning top candlestick pattern. We will cover its meaning, definition and ways you can improve the pattern. In addition to that, we’ll also share a couple of example trading strategies. If you leave the lower shadow and think about what happened in the market, it indicates that the bulls tried their best to push the market higher, however they were not successful. By the end of the timeframe the price actually came back to almost the same level where it started.

It does not provide the trader with a trading signal with a specific entry or exit point, unlike the marubozu. Our chat rooms will provide you with an opportunity to learn how to trade stocks, options, and futures. You’ll see how other members are doing it, share charts, share ideas https://g-markets.net/ and gain knowledge. Most markets have some type of seasonal or time-based tendencies, meaning that they aren’t equally bullish or bearish all the time. For example, there might be certain days, months, hours or weeks, that time after time show bearish or bullish tendencies.

Want to know which markets just printed a Spinning Top pattern?

This ended up being a reversal candle, as the price proceeded lower. The close and open prices on a spinning top are never far apart, regardless of whether the close is above or below the open. For example, in quite a lot of our strategies we use the day of the week to ensure that we don’t take trades on those days where the strategy hasn’t worked well historically. If you have read about the Doji pattern, you might be a little confused by now, since it closely resembles a spinning top. Both spinning top and shooting star have small body non-zero body and long wicks.

- However, a spinning top can signify a future price reversal if confirmed by the next candle.

- Instead of the spinning top or doji itself, a big move that occurs following it provides additional information about the next probable price direction.

- The spinning top illustrates a scenario where neither the seller nor the buyer has gained.

- It is followed by a down candle, indicating a further price slide.

The main difference between a shooting star and Spinning top is that the shooting star has no wick on the bottom side , while spinning top has wicks on both sides. A spinning top with low volume on the other hand may indicate that the market is about to make a big move and one should look for the break of the candle on either side. A spinning top with high volume generally indicates that consolidation phase is going to continue and one should stay out of trading or stay with existing trade if already in one. Breakout above or below a Spinning top can indicate continuation of uptrend or downtrend.

Cat and Moon Candle Carousel

The two patterns are nearly identical, with very small differences that in fact are negligible. Spinning top gets higher importance when it occurs at a pivot level , support or resistance and Fibonacci level. One of the toughest tasks we face as traders is timing when and where large… Whoever wins will control price, but that will only show on the next candle, not the spinning top. During this down move on Usd/Jpy, three spinning tops formed, followed by a sharp decline. We don’t actually get an entry in this case – after the top, price reverses on its own and jumps higher.

A spinning top is a candlestick pattern with a short real body that’s vertically centered between long upper and lower shadows. The candlestick pattern represents indecision about the future direction of the asset. It means that neither buyers nor sellers could gain the upper hand. When spinning top candlesticks occur at the top of a bullish trend, the bulls are losing control. A spinning top is a one-candle reversal pattern that signals uncertainty in the market, and is preceded by either an uptrend or downtrend.

Candlestick Inside Bar Swing Trading

A Red spinning top at the end of an extended uptrend and a green spinning top at the end of an extended downtrend has more chance of reversal happening. There are a few ways to trade when you see the spinning top candlestick pattern. Most traders use technical indicators to confirm what they believe a spinning top is signalling, because these indicators can provide more insight into price trends. Price movements within the spinning top candlestick indicate that buyers and sellers are overriding each other, resulting in homogenous open and close price trends. Using the spinning top pattern in a trading strategy will help the trader work within the minimum suggested investment time. The best way to learn to read candlestick patterns is to practise entering and exiting trades from the signals they give.

The spinning top candlestick chart pattern is a formation that occurs when buyers and sellers balance each other out, resulting in similar opening and closing price levels. Because of this relatively small change in market direction, this candlestick is known as a continuation pattern. During an uptrend, the Spinning Top candlestick pattern shows a possible reversal because of fewer potential buyers. During a downtrend, it also indicates a price reversal because of fewer sellers in the market.

No Comments